Unlocking the Value of Combination Therapies

In our previous blog we discussed how analyses of the impact of H.R. 3 published by the Congressional Budget Office (CBO) do not reflect the process of investing. Here, the third blog in our Series, we discuss another problem with…

In our previous blog we discussed how analyses of the impact of H.R. 3 published by the Congressional Budget Office (CBO) do not reflect the process of investing. Here, the third blog in our Series, we discuss another problem with their analysis: how they measure the output of innovation.

In our previous blog we discussed how analyses of the impact of H.R. 3 published by the Congressional Budget Office (CBO) do not reflect the process of investing. Here, the third blog in our Series, we discuss another problem with their analysis: how they measure the output of innovation.

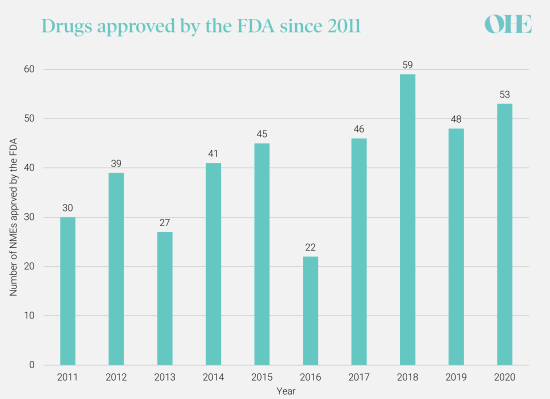

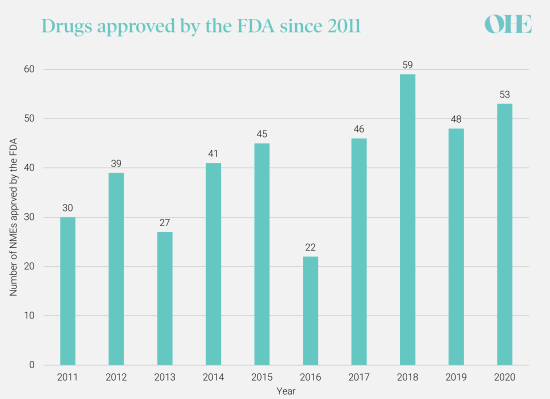

The CBO measures the impact of H.R. 3 on innovation by the change in the annual number of New Molecular Entities (NMEs) approved by the FDA. They project that 8 therapies would fail to reach the market during the first decade as a result of H.R. 3, and a further 30 therapies would be lost in the subsequent decade.

The CBO arrive at these numbers by estimating percentage reductions in the number of NMEs from an assumed baseline of 30 NMEs annually. This baseline has been disputed. The 10-year average from 2011 was 41 and the median number estimated by the experts we surveyed in our recent study for PhRMA was 45. As the CBO analysis estimates a percentage change, a higher baseline number of NMEs would generate a higher estimate of the number of drugs lost. Most of the experts we surveyed believed both the CBO’s assumed baseline annual number of NMEs and the projected reduction in NMEs were too low. Additional concerns with the CBO’s estimates of the projected reduction in NMEs are the topic of our next blog.

More importantly, the measure itself is too simplistic to capture the true impact of H.R. 3 on innovation. It’s not the volume of innovation that is important, but the value of that innovation. In health care innovation should generate “value” by (1) improving patients’ quality and/or or length of life and/or (2) reducing the costs of achieving these health objectives. A simple count of the annual number of NMEs is, at best, a proxy of the underlying features of health innovation. It also tells us very little about the size or distribution of the impact on innovation across diseases.

The CBO use a constant rate of NME approvals over the 20-year policy horizon, but the experts in our study suggested that developments in technologies like genomics will contribute to an increasing rate of NMEs approved each year. These enabling technologies give scientists a better understanding of the biology underpinning disease and drug development has become much more targeted because scientists know the structure, sequence, and role of so many molecules involved in diseases.

CDER’s annual novel drug approvals, 2011-2020.Source: New Drugs Approval Report 2020 (fda.gov)

Technologies have also led to a reduction in the average target patient population size. In 2020, 58% of new approvals were for rare or orphan diseases. Molecular and genetic techniques allow better stratification of diseases and more precise definition of the target patient group most likely to benefit from a therapy. For example, cancers that were traditionally classified by the organ affected (e.g., bowel cancer, or breast cancer) or the appearance of the cells under a microscope, are now genotyped. Now therapies target cancers with characteristic profiles of cancer-causing genetic changes which affect smaller patient populations.

NMEs generate different amounts of health value

This may seem intuitive, but drugs generate different amounts of value. The total value a drug delivers depends on how many patients will benefit and how much health gain the drug generates for each patient. Some drugs target diseases with large patient populations, for example the antiretroviral therapies developed in the 1990s to treat millions of HIV patients worldwide. Others, like orphan drugs, are more specialized and target rare diseases with small population sizes.

Innovation can also be also classified by how much health gain is achieved for each patient i.e. ‘breakthrough’ innovation or incremental innovations. For example, atorvastatin, the most frequently prescribed chronic medication in the US, clearly generated tremendous aggregate value for millions of patients over the last 25 years, but the incremental gain per hypercholesterolemic patient is relatively small. On the other hand, new life-saving, curative therapies, such as those for treating spinal muscular atrophy, may provide enormous health gains for each patient– though for a small population.

The CBO do not explore the impact of reduced NMEs on patient health, when clearly scientific advances are affecting both the number and distribution of the types of new medicines across disease areas. Some NMEs that the CBO estimate will be lost due to H.R. 3 may be the 5th treatment on the market for migraines while another may be a cure for Alzheimer’s. One society may be willing to forego, while the other would be a significant loss because it is so high value.

The experts we surveyed unanimously agreed that this trend means comparing NMEs today with NMEs in 20 years-time is meaningless in terms of health impact – the measure we ultimately care about.

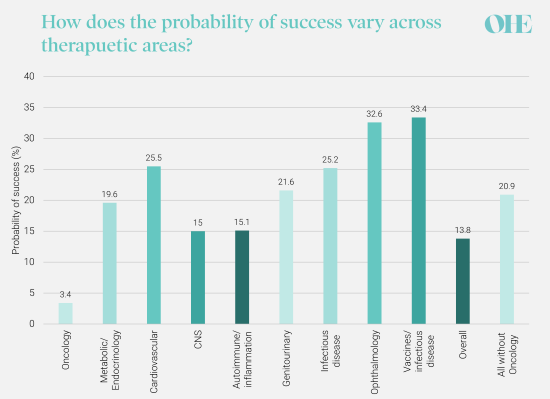

H.R. 3 is likely to affect some therapeutic areas more than others. As we outlined in the previous instalment of this Series, investors make decisions by balancing the risk and returns on their investment across their whole portfolio of investments. Many of the experts we interviewed believed that high-risk therapy areas would be particularly badly affected by reductions in R&D investment because of the need to minimize portfolio level risk.

What do we mean by high-risk therapy areas? A therapeutic area is high-risk if the probability of success (i.e. a drug is launched in that indication) is relatively low compared to other therapy areas. The probability of success is a function of many things, but an important factor is the scientific understanding that is contributing to increasing rate of NMEs and smaller population sizes, as we discussed previously. In some disease areas, like neurology and metabolic disorders, genomics and other technologies have not had the transformative effect that they have had in areas like oncology and genetic diseases. In these complex diseases, understanding of the disease and how therapeutics could prevent or alleviate the disease, is still poor and increases the scientific risk in drug development.

Overall probability of success across all development stages by therapeutic area. Source: Wong et al. 2019 https://pubmed.ncbi.nlm.nih.gov/29394327/

In addition to scientific risk, commercial risk can vary across therapeutic areas. In areas, like antibiotics, scientific understanding is relatively high but there is a commercial risk that health systems will not be willing to provide the returns biopharmaceutical companies need to secure future investment. The market failings of antibiotic development have been well documented, including by OHE. There are also many other sources of risk that vary across therapeutic areas that contribute to varying probability of success across therapeutic areas.

Experts also suggested that as the target of price caps under H.R. 3 is based on expenditure in Medicare, which covers the elderly, drugs targeting this population could be adversely impacted. In areas with higher risk like neurology, exposure to the Medicare population may compound the risk effect.

The CBO analysis also fails to account for the interdependence of innovation. Firms learn from one another’s successes and failures. We often see several follow-up entrants in areas where a proposed mechanism of action has been validated. Studies have shown that failures can lead competitors to cease development of compounds with the same target mechanism of action and disease area, redirecting effort to more promising areas. In addition, some innovations are platform technologies that can be redeployed in lots of areas – for example the mRNA technology that underpins some of the successful Covid-19 vaccines was developed for use in cancer. Reductions in the total size of the industry will also reduce these opportunities for information-sharing and collective scientific advancement.

Because of the factors we have discussed, the CBO’s use of aggregate NMEs as a measure of innovation lost through H.R. 3 is misleading. But more importantly, as we cannot make the link between NMEs lost and the health improvement lost, judging the impact of H.R. 3 on innovation is a big gamble.

In the next instalment in the OHE H.R. 3 Series, we will discuss why there is too much uncertainty in the CBO model to rely on their conclusions.

An error has occurred, please try again later.

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.

This website uses Google Analytics to collect anonymous information such as the number of visitors to the site, and the most popular pages.

Keeping this cookie enabled helps us to improve our website.

Please enable Strictly Necessary Cookies first so that we can save your preferences!